Ever asked the question WHY markets must go up? Have you ever thought the possibility exist for markets to crumble to 0 if the right conditions come about?

As long-term investors, it is vital to understand the fundamental concept of appreciating markets. Without this basic knowledge, you are likely to become emotional during temporary declines.

I challenge you to forget about the concept that markets increase due to company innovation, increasing earnings, consumer confidence, job creation or even economic growth. These are all important variables…but not THE variable. We are going to take a quick journey to simplify investing in the most basic and fundamental variable: Consumption.

The story of you

We all started out with nothing. At some point, we began to receive something; gifts, allowance, wages. No matter how much of a penny pincher we may be, we all started spending / using some potion of what we received to get more stuff. Stuff to feed us, cloth us, entertain us. As we age we continue to buy stuff. Some stuff we need and some we want. It is inevitable… the older you become the more lifetime stuff you have purchased. We all consume. For most, we not only consume but consume more as life goes on. Wage increases, growing families, among other motivations drive us to consume more.

So what is the point? Everlasting demand for consumption has existed since the beginning of mankind. We will always buy more goods to satisfy needs and wants. As such, others will always have an ability to supply goods to meet the needs and wants.

Let’s take a close look at 3 concepts that provide support for an ever-increasing consumption.

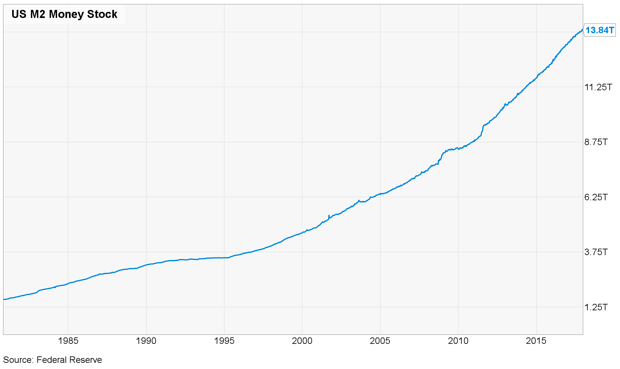

1. Supply of Money

As long as the supply of money in our economy is increasing, people will need to use the money in some way. Imagine you have a salary that gets a raise each year. This is the fundamental basis for your consumption continuing…correct? Each year you will save it, invest it, or spend it. As long as the money supply is growing then consumption is growing and thus the market has an ever-increasing pool of available money for investments and growth. Will the stock market gain another 100%, 1000%, 10000%…..YES. We do not know how fast or how it will happen. But as long as money supply keeps growing (a key assumption) and people keep consuming then the answer is yes.

2. Power of Interest and cash flow

If we understand that increasing money supply leads to more consumption, then we can assume prices will increase over time (inflation). Inflation is what creates the need for saving and investing. If we have no inflation, then longer-term savings becomes much less appealing. However, when we know prices will be higher years from now and we do not have the ability to buy all the goods we need today…..the solution is receiving interest or returns that match, or outpace inflation so we do not lose our spending ability. This is the reason you hire us for retirement planning. You need a solution to save enough money to bridge the inflation gap to supplement your future spending habits. This creates the demand for saving and investment solutions. Even in the worst case scenario when everyone decides they no longer want to invest, they still are consuming goods to eat. Those companies will still receive money and be able to make a profit. At some point, that profit will be returned to investors in form of dividends or the company buying back stock that will eventually cause market growth. As long as the money supply is growing and consumption exists, the market will eventually go up.

3. Demographics

The biggest risk to money supply and consumption long term is demographics. Think for a moment about a 4 person economy. We will call the Four; Jeff, Steve, Julia, and Mike. Steve produces Jimmy Johns Sandwiches for the others (a much-needed resource!). Steve makes a good living. However, one day Steve starts to fancy Julia. A few years later they have added 5 kids to the small economy. These kids love Jimmy Johns as well and now the group asks Steve for 9 sandwiches a day. Steve sees the opportunity and must save a little each day so he can eventually hire someone to help make sandwiches. He hires Jeff, a true Jimmy Johns artist. Jeff and he rule the sandwich world and both now make more money since 9 sandwiches produce more for both. By this time Steve’s kids have now all married and the group is now over 20 sandwich consuming customers. We could continue with this logic, but you get the point. Demographics drive consumption long term.

So what happens if the demographics start to reverse? Imagine our sandwich makers Steve and Jeff could no longer sell 20 sandwiches. Well, profits decline…pay goes down…and eventually, the economy slowly reverts back. UNLESS we perhaps invite a neighbor to join our little group. In this way, proper immigration can help countries bridge demographic gaps. In short, as long as the overall demographics stay stable or increasing, the long-term money supply and consumption trend should be positive.

Conclusion

Many things can and will hurt consumption and money supply temporarily. Fear, politics, regulations could always place a hold on forward-moving consumption. However, it does not stop the demand. It simply is a pause button while the demand builds behind the scenes. These pauses can last long enough to cause serious pain. Within a free market society (society of fair laws and void of a totalitarian rule), these pauses are temporary in nature. Financial Planning is a very effective strategy at navigating the short-term pauses so they do not infringe on your goals.

The markets recent take off from 2009 to now is an example of an economy and market returning to normal after a temporary pause of money supply and consumption took place. A pause or slowdown will most certainly happen again and in new ways. However, the long-term trend should be more money supply and consumption as long as our demographics and freedoms remain stable and growing. Temporary blips such as recessions can and should be expected and included in comprehensive planning. Understanding the fundamental variable of consumption allows us to weather storms and remains steadfast in our disciplines as we wait for the demand to show and markets to continue upwards. Given enough time, diversified investing holds one of the highest probabilities to benefit from growing consumption, and generate long-term wealth increases.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.