To the Clients of Evergreen Wealth Management, LLC:

Thank you for the opportunity to help steward your financial journey! We feel amazingly blessed to walk alongside each of you and your families.

The year 2021 was generally strong for investments, financial plans, and our business. Despite headwinds such as inflation, supply chain issues, covid variants, collapse in ‘hot tech’; we moved forward nicely. We are in awe of the blessing we have received and remain steadfast in our commitments to uphold stewardship of your assets to the best of our combined talents. We hope this review will help you better understand what has occurred and why we do what we do.

Review of 2021

In 2021, the major stock indexes showed strong growth. For example, the Wilshire 5000 Total Return Index, an index of 3,687 company stocks, increased 24.71% and the All-Country World Index increased 18.66%. The Barclays Aggregate Bond Index, however, declined -1.78%. Taking an even longer-term view, since 1992, the Wilshire 5000 Total Return Index has grown 1,111% (about 8.70% annual return rate). A time horizon of 30 years is a great measure to judge the effects of compounding and the health of a market with related economic activity. We find 1,000%+ over 30 years to be a healthy rate of return. Anyone who followed a prudent savings plan, remained calm during storms, and allowed the underlying market-based companies to simply compound is very pleased with their results. Evergreen’s approach to managing money was founded on this long-term market philosophy. Here is an eye-opening real-dollar perspective of investing in the stock markets: $100,000 invested in 1992 would be worth about $1 million today. Had you added $5,000 per year over that time (roughly 10% savings on average income in 1992) then the $100,000 would have grown to near $1,866,000. One of the secrets to investing remains quite simple: let the money compound over long periods of time.

Contrary to long-term compounding, philosophies such as chasing hot stocks or attempting to time markets have generally not worked out well over time. As the crowd of speculators grew larger and louder in 2020/2021, we chose to remain focused on owning strong companies that offer a reasonable rate of return and who consistently compound their cash. We generally choose to ignore investments that cannot provide sufficient profit today and increased profits down the road. We define this as ‘Earnings Power’. In 2020/2021 we saw many ‘hot trends’ such as investing in crypto currencies or meme stocks as susceptible to large implosions. These speculative bets rarely workout because they hold very little earnings power long term. As a result, many trendy investments came crashing down in 2021. Another issue we saw manifest itself was market timing. We avoid this action because it actually removes earnings power over time and is very difficult to execute successfully. Many speculators who have attempted to time the COVID pandemic with their investments lost out big time. We work very hard to resist falling for these emotional temptations, lest they become traps. If owning wonderful, cash-generating investments for 30 years can produce 1,000%+ returns during that time, without unnecessary risks, then why would we not follow that philosophy? Over the past 30 year timeframe, the markets experienced a dot com bubble collapse, a systemic financial collapse, multiple interest rate cycles, multiple election cycles, multiple wars, and yet it worked! Call me old fashioned, but we are very content owning an investment combination that offers us a high probability of long-term success. This long-term focus is the key to investment success. We will never underwrite the risk and return of an investment over any given one-year period; instead, we are looking for durable investments that can stand the test of time.

Some thoughts on 2022

“In the short run, the market is a voting machine. In the long run, it is a weighing machine.” – Benjamin Graham

We are entering a time where volatility is entering back into the markets, and it may not go away quickly. The winds that had previously been at our back are starting to reverse. The Federal Reserve will likely raise interest rates a significant amount in order to battle inflation, government stimulus will be greatly reduced from COVID levels, supply chains will still need to recover for a few more quarters, and labor force shifts will need to be better aligned inside companies. We knew the unwind and recovery from COVID would come with many pain points and we’re beginning to experience them now. You cannot experience the shock we went through and expect a perfectly smooth recovery; as such, we have expected some significant bumps along this road. And while the possibility of outcomes is still quite varied, we believe the long term remains favorable for US investors.

In the near term, the Federal Reserve will raise interest rates until inflation is perceived as under control, which greatly elevates the uncertainty level of markets and economic activity. The market is much more likely to bounce around during periods of uncertainty, and rising rates is a major variable. Could the Fed go too far and cause a recession? Yes, it is possible. Could supply chains heal quicker than we thought and bring inflation down faster, which would stop rate hikes sooner and cause markets to rally in a large way? Yes, this is also possible. Could corporate earnings keep growing even with an inflation induced recession happening, allowing the markets to largely stabilize? Yes. In the short term, many scenarios could play out that drive temporary asset pricing. If I told you we would have a pandemic, shut down massive parts of the global economic activity, and still gain 48% in the Wilshire 5000 since 2020, well, you would have called me nuts. Things well out of our control can swing short-term variables at any given moment. Thankfully, we do not focus on the short term. In the long run, markets always return to sound fundamentals such as profit growth. After an amazing stretch of market returns, taking a pause or even a larger decline would not be the worst thing for investors, as much as we don’t want to hear this. But the important factor is not short-term movements, but what happens with companies and investments we own in the long run. Which leads us to the most important question as an investor: What is our compounding advantage?

When Markets Decline – Understand Compounding!

“The first rule of compounding: Never interrupt it unnecessarily.” – Charlie Munger

Why would we become happier as markets decline? Not to sound like an undertaker at the morgue, but we are starting to get a little excited at some of the recent declines. Let me explain our fundamental perspective on where exactly this excitement comes from.

If you have a firm grip on compounding and own solid businesses, a market decline does very little except help you in the long run. Understanding the simple concept of compounding is key to remaining ‘un-emotional’ and focusing attention on the correct dynamics. Albert Einstein once described compound interest as the “eighth wonder of the world” saying, “he who understands it, earns it; he who doesn’t, pays for it.” We do not want to pay for it and so we really want to make sure everyone understands this concept.

Here is a simple thought exercise you may have heard before that demonstrates the power of compounding:

You are given the choice between two sums of money:

· Choice 1: One million dollars

· Choice 2: A single penny that doubles each day for 30 days

Which should you choose?

THE PENNY! And the amount after 30 days may surprise you. It turns out that after doubling 30 times, the penny choice would now give you a staggering $10,737,418.

This is a wonderful thought experiment that highlights the power of compounding. It also explains almost everything you need to know about declining markets. Up until day 27, taking the one-million-dollar lump sum would have been the better choice. However, from day 27 forward, the compounding ability destroys the $1 million option. Just 3 days later, you have made an extra $9,737,418! This is the exact choice many market participants will face as markets begin to decline. Every day, we are given the choice to remove our money and take that $1 million offer (so to speak) or allow our investments to compound. When things start to get rocky, many people will take the choice to stop the compounding out of short-term fears. Sometimes those fears will play out and markets decline…but under the hood, good companies keep compounding. Similar to waiting until day 27, it can take time for the compounding to prove itself as the superior option, but given enough time, it always wins.

During market declines, many people and institutions place their focus on the wrong element. They place undue focus on short-term price or the ability to cash in the chips and take the $1 million. The correct focus should be the compounding rate of profits! Let’s expand on why this is so important. Grab a coffee and prepare to engage your brain on this one.

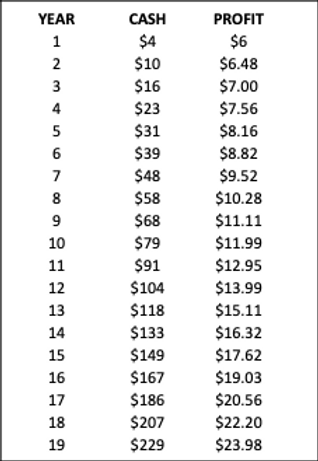

Imagine for a second that a company declines from $100 to $40 in value. That’s a 60% decline…ouch. It would be very easy to become emotional if you only look at the price component. But you are wiser than the rest so you know to look under the hood at the REAL value of a company, its ability to compound. You learn the company is completely debt free and actually holds $4 in cash. In addition, they receive $6 in free cash flow (cash in your pocket after all costs are paid) each year. And let’s say this ‘cash in pocket’ is growing at 8% each year. In five years’ time, the company would now hold nearly $40 in cash and have over $8 coming into the business each year. If the company stock still traded at $40, they could purchase the full company back and would be wise to do so since it would provide a 20%+ cash flow yield. More likely, the market would sober up in that five years as the company keeps showing cash flows, and eventually they will jump back in and bid the company price back up much higher than $100. This is compounding in real terms. The company is building the cash it has at 8% plus it already has a good cash pile. Eventually, this compounding will win BIG, just like the doubled penny example. Even if the market ignores this company for a decade and the stock declined to $0, we would make all of our money back from cash flow in 10 years and have an amazing compounding machine. Naturally, this won’t likely happen because if the company keeps executing on this plan, the market eventually sobers up and pays a fair price for it. But, the power of compounding can’t be denied.

Company Compounding 8%

“Investing is simply maximizing the rate of compounding for as long as capital can be employed net of fees and taxes. What strikes us as strange is how little we hear about compounding with regard to investing. We find the short-term perspective affecting the collective market psyche is focused on direction and immediate results that often limit the ability to truly accomplish outstanding rates of compounding.” – Christopher Begg

Unfortunately, many investors do not view investing through a compounding lens. Most do not even fully grasp the power it provides if left alone for a long time. Few investors have a true 1-3 year time horizon, let alone a 3-5 year time horizon. This sad fact is nothing but a benefit to us in the long run. If we stay focused on owning the pennies that have large compounding rates, we can benefit greatly when investors panic and want to unload shares at ridiculously cheap prices. It won’t matter to us since we understand compounding math. We focus on the business’ ability to compound cash flows over the long term. If the company can keep doing that, then we are happy to welcome the declines of the market…and yes, we even get excited!

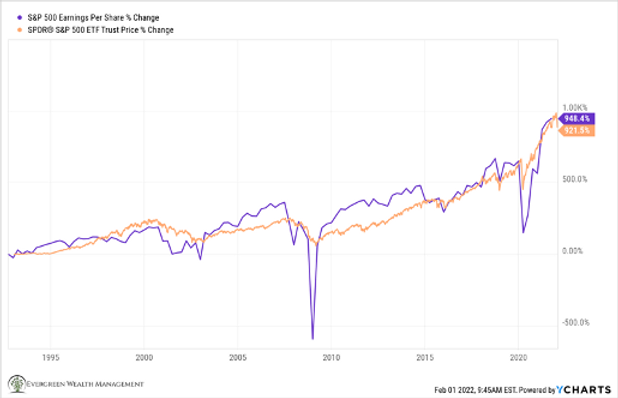

To hammer this point home even more, the chart below offers a slam dunk reminder on the simplicity of investing! Own compounding profits (earnings per share, or EPS) over a long time! As long as profits (EPS) continue to compound, then we can hold a reasonable expectation of solid returns to meet our planning needs in the long run, regardless of short-term conditions. The graph below shows the power of compounding earnings (purple line) and what eventually happens to market returns over time (orange line). As this clearly shows, given enough time, the compounding earnings will pull the market upwards. Yes, earnings will decline from time to time, but if the companies and investments we own can rebound and compound long term, then we are not worried about short-term declines and will try and use any volatility to our advantage.

Closing Thought

2021 proved to be another wonderful year all around. The possibility of challenging outcomes in 2022 has likely expanded as we face new headwinds.

We focus on owning investments with long term earnings power and a high probability of compounding success. If we can enter these investments at a reasonable price and hold reasonable expectations, we would see little reason to trade in and out of such investments. We find emotional instincts serve as a very poor compass for financial decision making. Rather we establish a sound long-term plan and align our decision-making framework with this plan. We establish proper risk controls well before the storm happens, so clients can remain somewhat comfortable in the boat as the storm hits. Staying inside the boat has consistently proven the best way to survive storms. Just like a private investor, we act as an actual owner of a business and focus on the REAL economic value each day. If the real value continues to compound, we know the markets pricing will eventually be reflected. Sometimes this happens immediately (as in the past five years), while other times it can take years. Thankfully, we like to hold investments for many years to allow the internal compounding of the real business to work its magic. Of course, sometimes a business will change course or even sell for a ridiculous price. We remain vigilant to identify any changes or extreme price disconnects, and if necessary, we will sell to take profits or to rotate to better opportunities.

We never know exactly what the future holds. The market will go up and down to some extent in 2022. We will remain laser focused on the real business values and aim to maintain a healthy group of investments that can compound in line with your long-term financial plan.

Let me again say THANK YOU! Our success together is an equal part great team, great advisors, and great clients. We feel extremely blessed to get up every day and do exactly what we love doing. If we did not serve such great families, we would not love what we do nearly as much. It remains a tremendous honor to steward your hard-earned assets and continue helping you meet your long-term objectives. We look forward to a great 2022 and beyond!

Disclosures

Index results such as the Wilshire 5000 and S&P 500 do not reflect management fees and expenses and you cannot typically invest in an index.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.