Is now the right time to Invest in the Stock Market?

Meet my good friend Barren Wuffet. (Yes this is a fictional story, and yes I did switch the letters of Warren Buffett to make up the name).

He is by far the worlds worst stock market timer. As an investment manager, I tried explaining to him how hard market timing is, but he never listens. He started his working career at age 25 in 1975 and had an idea of setting aside 10% of his income at the beginning of the year in cash. When he felt the timing was right, he invested all his savings in the stock market. For this example, Barren’s income was exactly the mean household income according to the US Census Bureau.

Barren invested in an S&P 500 index fund, reinvested dividends, and never sold a share in his life.

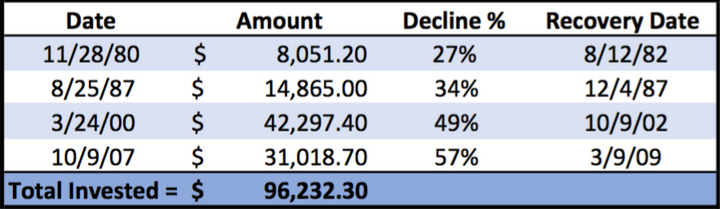

Barren felt excited and decided to invest his entire cash build up in the following time periods.

In 11/28/80 he had a cash build-up of $8,051.20 and invested all of it on that day. The market dropped 27% until it bottomed out 21 months later on 08/12/82. He did not feel comfortable until 8/25/87 and invested his savings of $14,865 on that day. In 3 months he saw his investments drop 34%. After the 1987 market crash, Barren didn’t feel the time was right to invest his savings until 3/24/00. The tech bubble lasted for 31 months and his investment dropped 49% over that time period. After the tech bubble of the early 2000’s Barren was convinced the best time to invest his built up savings was on 10/9/07. The housing crisis dropped 57% in 17 months. After the housing crisis, Barren decides to hold his savings in cash until he decides to retire.

If you understand stock market history, these dates are the very peaks of the S&P 500 before a large decline.

How did Barren, the worst stock market timer, end up during his investment time period before retiring at age 67 on 8/23/17. The index fund he invested in was worth $700,876.42 and had a cash savings of $51,675.80. So at retirement, he has $752,552.22 as his nest egg.

Not bad for the worst stock market timer.

How did he do that? How could Barren gather a comfortable nest egg for retirement when he invested at the absolute worst times? He didn’t make a huge amount and saved no more than 10% of his income in a year? He didn’t even dollar cost average every year. Instead, he invested at the worst times.

What did Barren do right?

I would first like to make clear past performance is no indication of future results. Some historical 42 year investment time periods would have produced results not as well as $752,552.22 (some may be better). No-one should try to mimic this strategy of building cash and trying pick the best times to invest your entire savings at one time. Investing entirely in an S&P500 index fund is not suitable for all investors. We recommend putting together an appropriate asset allocation designed for your personal investment objectives with an investment advisor.

Stay Invested

Over a long period of time investing in financial markets performs well. Is it possible to be a successful investor investing at all time highs? Yes!

Is it possible to be a successful investor trying to time in and out frequently in the market? Not likely.

Invest Consistently

Barren saved every year specifically to invest. Saving 10% a year is an appropriate amount. Ultimately the amount you should be saving every year depends on your financial goals. It may be more or less than 10% of your income.

A better approach than what Barren took would have been to invest at more frequent intervals (yearly, monthly, weekly) instead of parking your cash to invest years later, not knowing when you will buy in.

Re-Invest Dividends (Income from investments should not be overlooked)

If Barren wouldn’t of re-invested dividends, he would have had a nest egg of $361,760.16. Income from investments (dividends from stocks and interest from bonds) is a key element in investment performance.

In this example, dividends gave Barren an additional 3.53% return. For someone living off of their investments, using different income strategies could be essential when accomplishing your financial goals.

Start early (Maybe Now!)

Barren started saving for retirement at 25 years old. Investing early and allowing your investments to compound for decades works in the investors’ favor. Barren’s first investment of $8,051.20 in 1980 was worth $345,154.1 of his $752,552.22.

Some of you may say to me, “That’s great, but I am not 25 years old anymore.” Whatever your age, 25, 45 or 75, setting an investment plan to meet your financial objectives is necessary at any stage in life.

Stick to your Financial Plan

Barren had a plan to invest in the S&P 500 (a representation of the U.S. stock market) and he stuck to his investment until retirement. Is this an appropriate investment strategy for you, probably not. What made it work had to do with the actions listed above.

Assuming the financial plan you put together is appropriate based your investment objectives, risk tolerance, and your entire financial situation, sticking to it with a long-term mindset is important. Barren had a high-risk tolerance towards his investments. He didn’t change to a conservative risk tolerance after a market downturn and then feel more aggressive after markets experience a huge run-up. If your risk tolerance and financial objective equate to a 60% stock and 40% bond allocation, don’t change your investment plan to 80% stocks and 20% bonds when markets are good or 20% stocks and 80% bonds when markets are bad.

If you want a second opinion on your financial plan to see if it is appropriate for your financial goals, Contact Us. We are here to help.

Evergreen Conclusion

Saving more, thinking long-term and allowing compound interest to work in your favor are your biggest accelerants for building wealth. These factors have nothing to do with picking stocks or a complex investment strategy. Get these big things right and any disciplined investment strategy can work.

To answer the title of the article, “Is now the right time to invest in the stock market,” if you have a long-term investment outlook the answer is yes.

I think when I hear someone ask that question, what they are really asking is, “Is now the BEST (or worst) time to invest in the stock market.” There is no way to know ahead of time if now is the best (or worst) time. When someone is asking that question I think they are concerned if the next big bear market is around the corner. If someone is nervous about a stock market pullback, the answer is proper asset allocation, not stock market timing.

Keeping your money invested is the answer, but maybe your financial situation requires an adjustment due to risk tolerance, income needs, etc. Allocating a portion of your investments away from the stock market and into other asset classes or annuities decreases the risk a stock market downturn has on your financial goals. Some clients may require half of their investments in bonds and other liquid investments, others may need to annuitize a portion of their investments in order to set that income stream to last a lifetime.

The key is that the amount of your investments that should be allocated to the stock market depends entirely on your personal financial situation. Ultimately, you need enough invested in the stock market that is required to meet your financial goals. If you need help with this reach out to us. We would love to help.

1) U.S. Census Bureau

2) VFINX – used for index performance

Client returns and risk may experience deviation from model performance based on timing of deposits & withdrawals, among other factors.

Evergreen Wealth Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.